Mozambique could become home to the entire supply chain for electric vehicles (EV), according to a United Nations Conference on Trade and Development (UNCTAD) report last month which points to the rich deposits of graphite in the country and “promising trends” in capital and labour.

But while the report found obstacles as well as advantages to Mozambique’s current situation in achieving this goal, commentators who surveyed the report expressed scepticism that the country could become an EV manufacturing centre anytime in the foreseeable future.

“There’s no chance that Mozambique can create a competitive and unsubsidised car manufacturing sector,” said Charlie Roberston, head of macroeconomic strategy at emerging markets-focused fund manager FIM Partners in London. “Much more investment in human capital is the top priority for the next 10-15 years. Money invested instead in car manufacturing now would be a white elephant that would be a waste of Mozambique’s limited resources.”

Poorva Karkare, policy officer at the European Centre for Development Policy, said she was “sceptical” that Mozambique could become an manufacturer of EVs or EV batteries even in the long term, due to constraints of infrastructure, demand and geopolitics.

The demanding battery

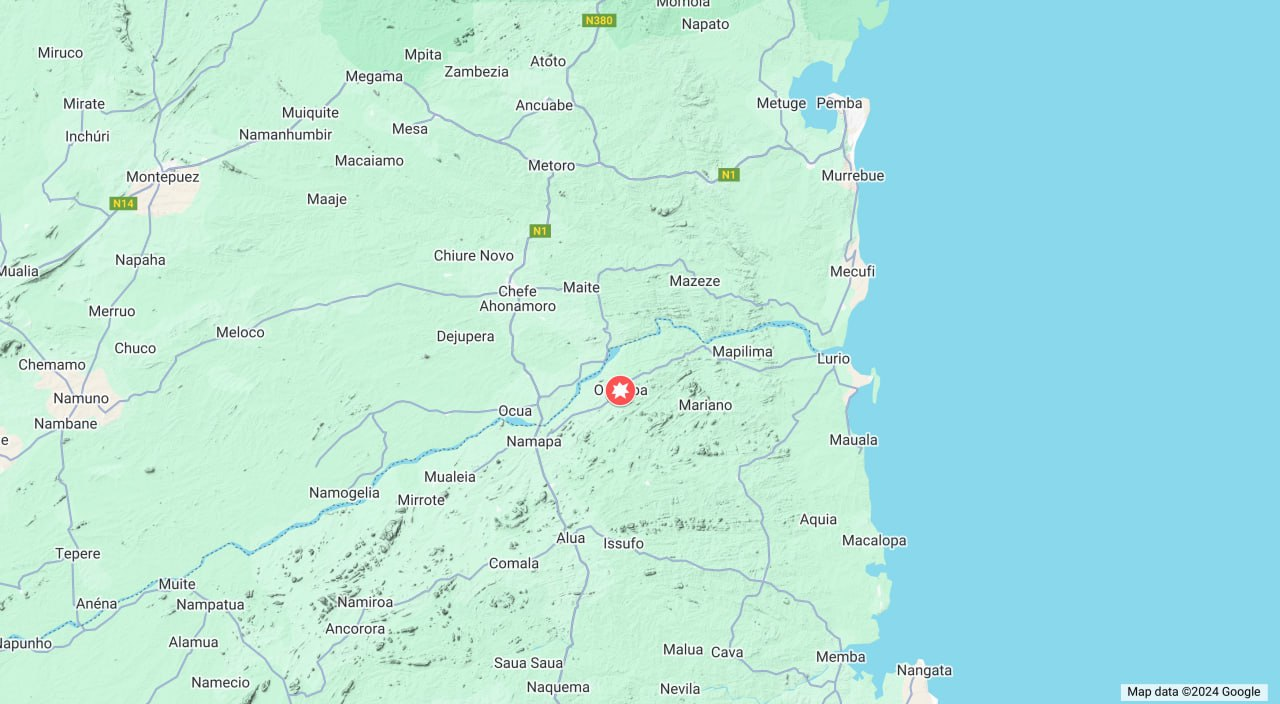

Graphite is a major component in EV batteries, as it is the preferred material for making anodes, the negatively charged electrode of the battery. One of Mozambique’s strengths, according to the report, is its reserves of natural graphite: the country has enough graphite to satisfy global demand on its own for 12 years at projected 2028 levels, the report claims.

EV battery production is highly capital-intensive, and the UNCTAD report cites growth of capital in Mozambique as an advantage: capital has been the biggest single contributor to economic output in Mozambique in recent decades, according to the report. Between 1996 and 2018, capital has consistently grown at over 5%, more than labour or technology. The report notes that the higher growth of capital than labour is due to the capital-intensive nature of Mozambique’s extractive industries, notably aluminium, coal and petroleum products.

But whether capital would flow to a manufacturing sector like EVs in the same way as it has flowed to extractives in Mozambique is contentious. EVs have a long supply chain: even if the batteries are produced by the car manufacturer, and many are not, the main materials, of which graphite is only one of five, have to be first mined, then processed. Batteries have four components: anodes, cathodes, electrolysers and separators.

Syrah plans to ship the graphite it mines in Mozambique to its Vidalia plant in the US state of Louisiana, where it will be purified and turned into so-called active anode material, before being taken elsewhere to be made into batteries. To attract investment in such production, Mozambique would need to be a viable place first to refine graphite, then to assemble EV batteries, then EVs. Many of the elements needed, such as cobalt and lithium, would almost certainly need to be imported from outside Africa or further afield.

Karkare argued that the demand for EVs or EV batteries did not exist in Africa to attract the investment needed. “Even in South Africa, which has some experience in automotives, no-one is planning for EV manufacturing because there’s no internal demand,” she said. Producing affordable EVs would mean subsidising some of the inputs, such as power or raw materials, she added.

“If you don’t have enough domestic or regional demand, it doesn’t make much sense for you to go into these things, because battery component production as well as battery production happens in places where it’s close to the end-use market. So in China they produce the components and straightaway use the batteries for solar storage or EVs. It’s not like steel or some other industry where you can produce and transport it. They do have an export component, but the most significant one is for domestic consumption.” She also pointed out that the US and some European Union countries offer subsidies to EV manufacturers, something the Mozambican government is unlikely to be able to afford.

Production of EV battery anodes is highly concentrated: according to a 2022 report by the International Energy Agency, only four firms in the world account for 50% of anode production and the top six companies are all in China, accounting for two-thirds of production. This raises questions about whether a new country entering the market would be viable.

Logistics challenge

Logistics are another constraint. If Mozambique does not have a regional market to supply with EVs or batteries, then it would need to export cheaply. Syrah told Zitamar in 2020 that it had chosen to base its anode production facility in the United States rather than Mozambique due to “access to low cost power and hydrofluoric acid,” as well as “co-location and proximity to potential customers.” Hydrofluoric acid is a key chemical used for refining graphite to the necessary purity. In October 2022, the US Department of Energy awarded Syrah a $220m grant to further expand its Vidalia plant, still under construction. Syrah claims that the plant will be the first major facility outside China for manufacturing active anode material.

The UNCTAD report acknowledges that logistics are an obstacle. In a 2018 report by consultancy PwC, Mozambique scored only 58% for “port operational effectiveness and logistics efficiency”, and its port efficiency was scored as being only 59% that of the highest-scoring port in Africa, Durban in South Africa. Since then, however, the ports of both Maputo and Beira have climbed above Durban in the World Bank’s Container Port Performance Index 2022. Efficiency apart, however, Durban remains a major regional hub for container traffic, better connected and with higher capacity than Mozambican ports like Beira or Nacala. “For EVs or batteries, it’s going to be to China, and for Mozambique; things don’t go directly to China,” Karkare said. “They go to Durban first, and then to China, because Mozambique doesn’t have the volumes. That goes into your transport prices.”

Technology is cited by the report as another possible brake, as technological growth as an economic factor input has actually been shrinking for the last decade. “[B]etween 2011 and 2020, patent applications for Mozambique numbered 196, an indication of scant technological development”, the report says.

Skills and labour

Although the report suggests that Mozambique could house the entire supply chain for electric vehicles and vehicle batteries, it cautions elsewhere that the “most viable option” for most African countries to get more involved in automotive manufacturing is the production of so-called tier 2 components, which are non-specific, as opposed to more technology-intensive tier 1 components ready for vehicle assembly.

A lack of domestic manufacturing capability has thwarted car assembly in Mozambique in the past. A Chinese-backed firm, Matchedje Motors, inaugurated a car assembly plant in Mozambique in 2014, building Chinese car models under a Mozambican badge. The company stopped producing cars three years later, citing an inability to produce components in-house due to a lack of skilled labour and raw materials, as well as being undercut by imported vehicles that were cheaper than cars it could produce. The company reportedly went bankrupt in 2018, and the factory was used to turn old buses into classrooms.

According to the UNCTAD report, labour growth has been unimpressive compared to capital growth, averaging 2.5% between 1996 and 2021, but it adds that 43% of the Mozambican population were aged 0-14 in 2021, a positive sign for workforce growth, “provided that policies to support labour are implemented properly”.

Charlie Robertson, however, argued that the Mozambican workforce was insufficiently educated to support industrialisation. This, he said, required 70-80% adult literacy, whereas Mozambique’s was estimated at 63% in 2021.

A fertility rate below three (three children born to each female over her lifetime) and enough electricity supply was also necessary to ensure enough investment in companies and in infrastructure, he went on, adding: “Mozambique has enough electricity but the fertility rate won’t fall below three – so it would require Mozambique to run a substantial current account surplus to offset the lack of domestic savings.”

Squeezed out

Beyond Mozambique’s shores, a bigger issue lies in the geopolitics of EV production, which has become an aspect of the political and military competition between China, Europe and the West. This is arguably reflected in the subsidies provided by the three blocs, and their desire to locate EV manufacturing locally. Karkare said it was a “major worry for those [African] countries” that they would be crowded out in a competition between China and the West.

“It would be naive to think that Africa tomorrow would be able to produce everything that you need for EV batteries or even electric vehicles themselves, because it’s starting off from a very low base,” she added. “But where this geopolitical competition is definitely squeezing them out is for instance refining; even moving just a bit higher in the value chain is becoming difficult, because of these subsidies.”

“My guess is, if those subsidies had been introduced much higher up in the value chain, you could potentially have seen Mozambique having an anode factory. It’s a possibility. But because they are so concerned with competition from China, they want everything to be produced in the US before firms can avail themselves of any subsidy. That basically means nobody is really going to have the patience to try and invest in an African country and build up the skills and economies of scale needed to compete more fairly.”

Karkare qualified her pessimism by suggesting that the government could still try to build up a refining capability for graphite. “Look at South Africa - South Africa is doing manganese refining and the manganese firm in South Africa is the only non-Chinese firm in the world.”

“If you have some proactive steps, maybe that can happen, but going directly for the moon and saying we’re going to start producing EVs, I don’t think is very helpful to think about,” she argued.

UNCTAD’s press office had not responded to Zitamar News’ request for comment by the time of publication.

This article by Zitamar News was supported by the African Climate Foundation.