Hello, and welcome to Zitamar’s weekly look back at the week that was, and look ahead at the week to come.

The scandal of Mozambique’s ‘hidden debts’ came back to the foreground last week. With a ruling in London due on 17 July, Zitamar was able to exclusively reveal on Thursday that Mozambique reached an 11th-hour agreement to pay $220 million to Russian bank VTB, and BCP of Portugal, to settle claims they had over money they lent to the shipbuilding and repair company MAM and the offshore security company ProIndicus.

For readers new to the saga, or those who need a refresher: Mozambique’s secret services set up three offshore defence companies: MAM, ProIndicus, and Ematum, which borrowed a total of $2bn from international lenders (and some Mozambican banks), led by Credit Suisse. All the money was spent with Lebanese shipbuilding group Privinvest, on fishing boats and patrol boats and associated technology. The borrowing was done in secret under the administration of President Armando Guebuza, with the then finance minister Manuel Chang signing sovereign guarantees for the loans without consulting parliament, as he was legally obliged to do. A not insignificant part of the money made its way into the pockets of various people involved in the deals; none of the three companies ended up doing anything useful.

Cue legal action from all sides, in Maputo, London, and New York. But now VTB and BCP have followed Credit Suisse and the other lenders in reaching an out of court settlement with Mozambique, leaving the judge to rule only on Mozambique and Privinvest’s claims against each other.

The Russian and Portuguese banks have done well out of the deal, at least compared with Credit Suisse which settled for nothing. Mozambique has agreed to pay a total of $220 million to the two VTB entities and BCP, and to pay it pretty much immediately: $125m was due to be paid yesterday, and the remaining $95m in two instalments, to be paid in August and September.

Where Mozambique is finding that money is unclear. The deal it reached with Credit Suisse and other lenders saw the country have to find $46m, which was financed by a one-off fine the government collected due to the cancellation of an unspecified LNG exploration project. We’re unaware as yet of any such windfall — let alone one four times as big — this time around, except for the latest instalment of money from the IMF, worth $61m, agreed a couple of weeks ago.

It’s perhaps no wonder, then, that Mozambique was so keen to ensure it secured that instalment, though the IMF is probably not delighted about the destination of all those dollars. Perhaps it was worth it for the Fund, though, to get Mozambique to cut its public sector wage bill, the condition for the release of those funds. As ever, it’s the Mozambican public that ultimately pays.

And a footnote to the settlement: next week will see a three-day meeting between Mozambique and Russia over the two countries’ relations. The long-running dispute with VTB will no longer be on the agenda.

But if Mozambique hopes it can soon put the scandal behind it, it is in for a disappointment. Former finance minister Manuel Chang is finally ready to face trial in New York, which should also start this month. While the London trials were largely about the ProIndicus and MAM deals, the New York trial looks set to focus on how Ematum was financed, or rather refinanced by selling to bond investors.

But although those investors may have been misled over what exactly they were buying, it is again the Mozambican people that will end up paying. Chang’s successor as finance minister, Adriano Maleiane (now Prime Minister), insisted on refinancing the Ematum bonds into plain old sovereign bonds whose legality cannot be disputed, and which the country is committed to repaying in full. It remains to see what financial crises that could yet cause in future, when repayments increase, in 2028. Plan A is that the country is rolling in from gas export revenue by then, but the likelihood of that is disappearing over the horizon as TotalEnergies continues to delay a decision on restarting the project. Key lenders such as the Dutch and, more importantly, American export credit agencies are also still reviewing their participation.

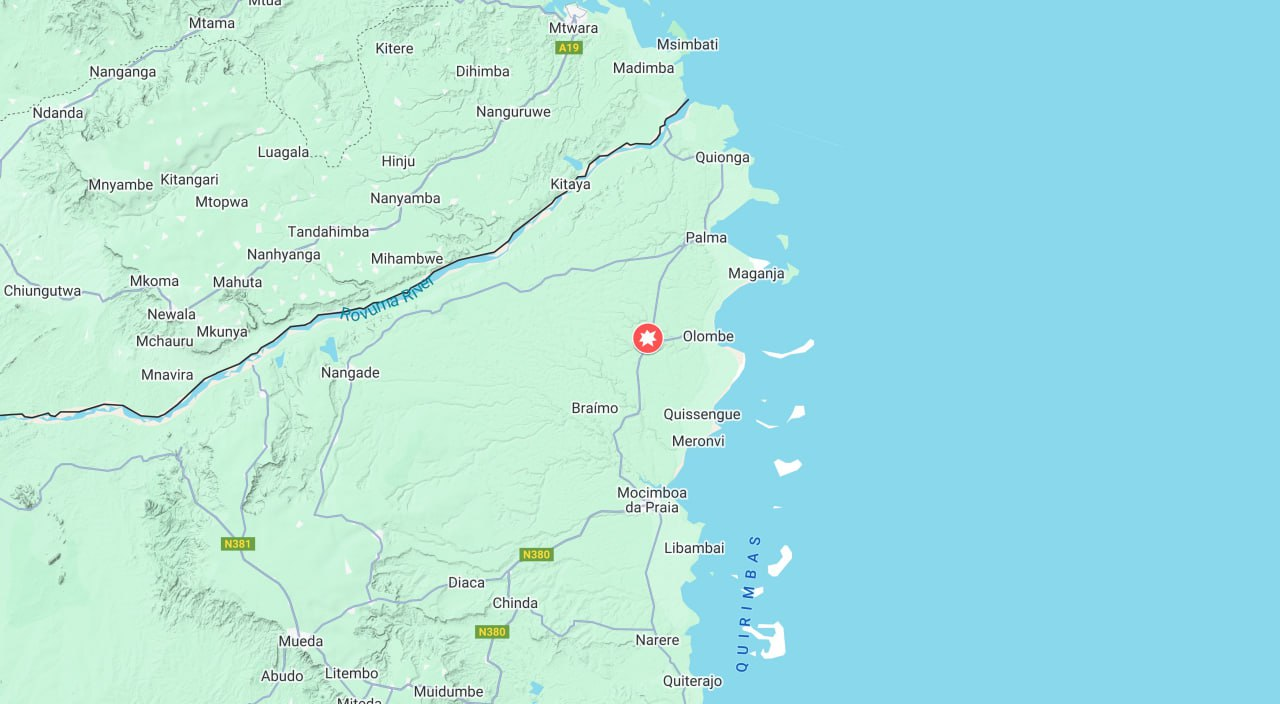

Those decisions are being complicated by continued attacks in Cabo Delgado, within the area that the projects particularly need to be safe. We report on the latest incident today:

Before we finish this newsletter, it is appropriate to mark the passing of two notable figures in Mozambican life over the last week. Chude Mondlane, the eldest daughter of Frelimo founder Eduardo Mondlane, passed away and will be deeply missed by those who remember her as a kind and generous artist.

In the same week, Mozambique and Maputo in particular lost the architect José Forjaz, who left a physical mark on the city and was also an important voice protesting against the ongoing degradation of the natural and built environment there. You can read an obituary of him in Portuguese newspaper Público, here.

And below you can find a taster of the insights we bring Zitamar News subscribers every week day, from just $12 per month. Hit the button below to join them today – or email subscriptions@zitamar.com for further information.

Week in Review

Monday

Large parts of Mozambique remain highly dependent on imported food, despite the country having plenty of land and agricultural potential to feed itself — something that shouldn’t need support from donors to make happen. Nor has further economic diversification happened — something that ought to be a priority as Mozambique prepares to become a major commodities exporter.

Making the leap to becoming an industrialised country will not be easy. But facilitating the population to at least be able to feed itself, is within the Mozambican government’s gift. These figures are a stain on President Nyusi’s legacy, that will obscure any achievement he leaves behind.

Tuesday

Public holiday for Mozambique’s Independence Day

Wednesday

Contraband fuel makes its way onto the market through other means, too. Cargo trains stop to allow thieves to syphon fuel out. Military officers are notorious for selling fuel belonging to the defence ministry on informal markets. Senior government employees, with fuel allowances of up to 500 litres per month, sell their allowance or the fuel itself.

And there is a ready market for this fuel: in particular, the public transport industry. The overcrowded, run-down minibuses on which millions of Mozambicans rely, happily buy cheap contraband fuel. The situation allows them to survive, and indeed make money, while charging the low fares the government forces them to charge.

Thursday

The presence on the ballot of a candidate as popular as Venâncio Mondlane, as well as the traditionally strong opposition parties Renamo and MDM, means the chances of the opposition together taking 50% of the vote are arguably higher than ever.

It adds up to a risky moment for Mozambique. If Mondlane were excluded from the elections, there would be an outpouring of anger, followed by apathy on election day. With him on the ballot, the vote, the count, and the tallying of results will be eagerly watched by millions of expectant young voters. If he makes it into a run-off, the tension will be higher. If Frelimo blatantly steals the result, the pressure cooker could explode.

Friday

It might seem at first glance that the target of this move is the current holder of both those offices, Filipe Nyusi. But he is coming to the end of his time as president of the country, and is expected to hand over leadership of the party too, if as expected Daniel Chapo wins the Mozambican presidential election in October. So instead, it could be an attempt to allow Nyusi to remain president of the party even if Chapo replaces him in the Ponta Vermelha.

As a point of principle, there is plenty to recommend the idea of diluting the arguably excessive amount of power held by one person, as president of both party and country. In Mozambique, the party and the state are far too closely intertwined, and this would help with some separation of powers.

However, it could also make the country even harder to govern than it already is. Nyusi’s time as president has been characterised by fighting with his predecessor for influence; if Chapo has to vie with his predecessor who was still president of Frelimo, his administration could be paralysed.

The party will always play an important part in reining in ambitious presidents who may wish to overstay their welcome in office, but separating the roles risks tipping the scales of power too much away from the country’s elected president. This is not to mention the potential conflicts of interest that may arise from a former president continuing as puppet master behind the stage. Had Guebuza remained president of the party it’s highly unlikely that any justice would have been served to those responsible for the ‘hidden debts’ scandal.