Good morning. This week, the Southern African Development Community (SADC) publicly confirmed for the first time that its withdrawal of troops from Cabo Delgado province is in line with its scheduled exit by the 15th of July this year. The SADC Mission in Mozambique (SAMIM) has been scheduled to end since July last year, when a leaked agenda from a meeting of SADC leaders reported that member states had agreed to end SAMIM within a year.

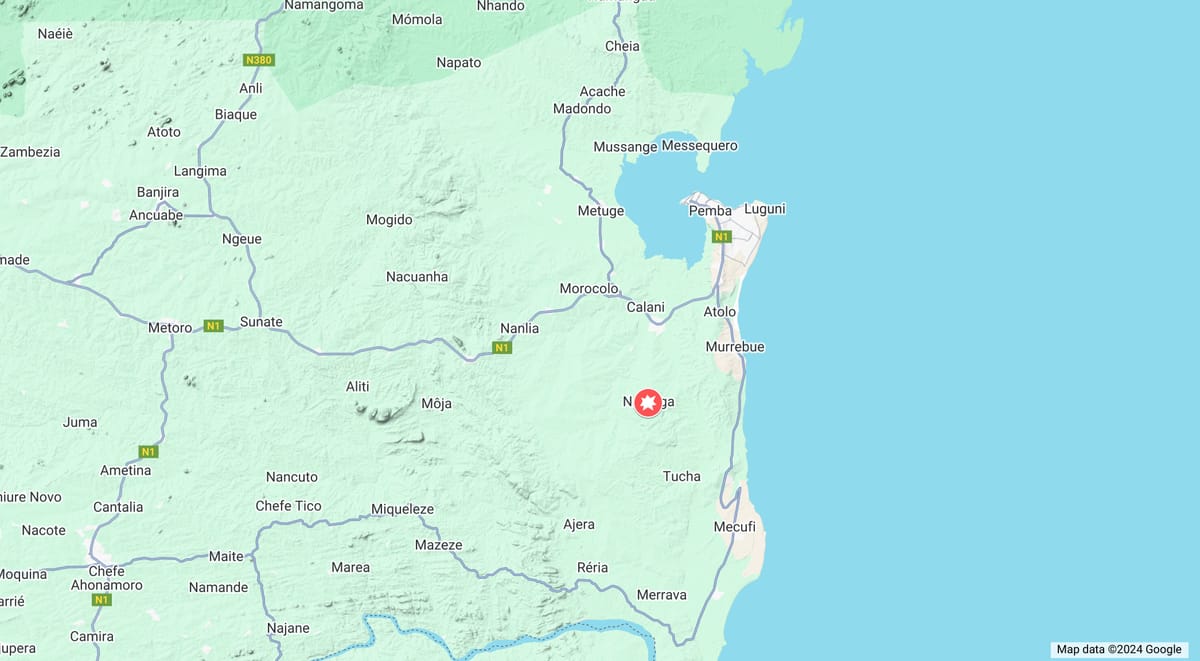

SADC troops are set to leave Cabo Delgado in a precarious security situation, with TotalEnergies’ $20bn liquified natural gas project expected to resume operations and an escalation in recent fighting with insurgents. Two Mozambican soldiers were killed on Tuesday, around 20km from the provincial capital Pemba, when a joint patrol of the Mozambican Armed Defense Forces and the Local Force militia was attacked by insurgents. Shortly before the ambush, insurgents also attacked the nearby village of Makawaya, kidnapping several civilians and burning homes. Following the attacks almost 100 people in the area fled to the coastal villages of Natuco and Sembenes in Mecufi, whilst groups of insurgents have been moving south from Macomia district.

For more stories on the Cabo Delgado conflict, see our usual weekly roundup from our daily newsletter below.

Have a great weekend.

Week in Review

Monday

The Islamic insurgents who occupy the village of Mucojo, in the coastal part of the Macomia district, have imposed strict interpretations of Islamic law, or Sharia, on residents, according to local sources. Since the occupation of Mucojo began on 18 January, they have banned certain haircuts, the sale of alcohol and the wearing of tight or tapered trousers, while encouraging people to practise daily prayers at mosques.

Despite the presence of FADM and the Southern African Development Community Mission in Mozambique (SAMIM) in Macomia, there has not yet been a serious effort to retake the lost territory. Furthermore, SAMIM confirmed that it has already started pulling out its troops in preparation for a complete withdrawal in July, putting an end to months of speculation about the future of the mission. As Zitamar argues, SAMIM is set to leave Cabo Delgado at a vulnerable moment, just as the insurgents are going on the offensive with renewed confidence.

Tuesday

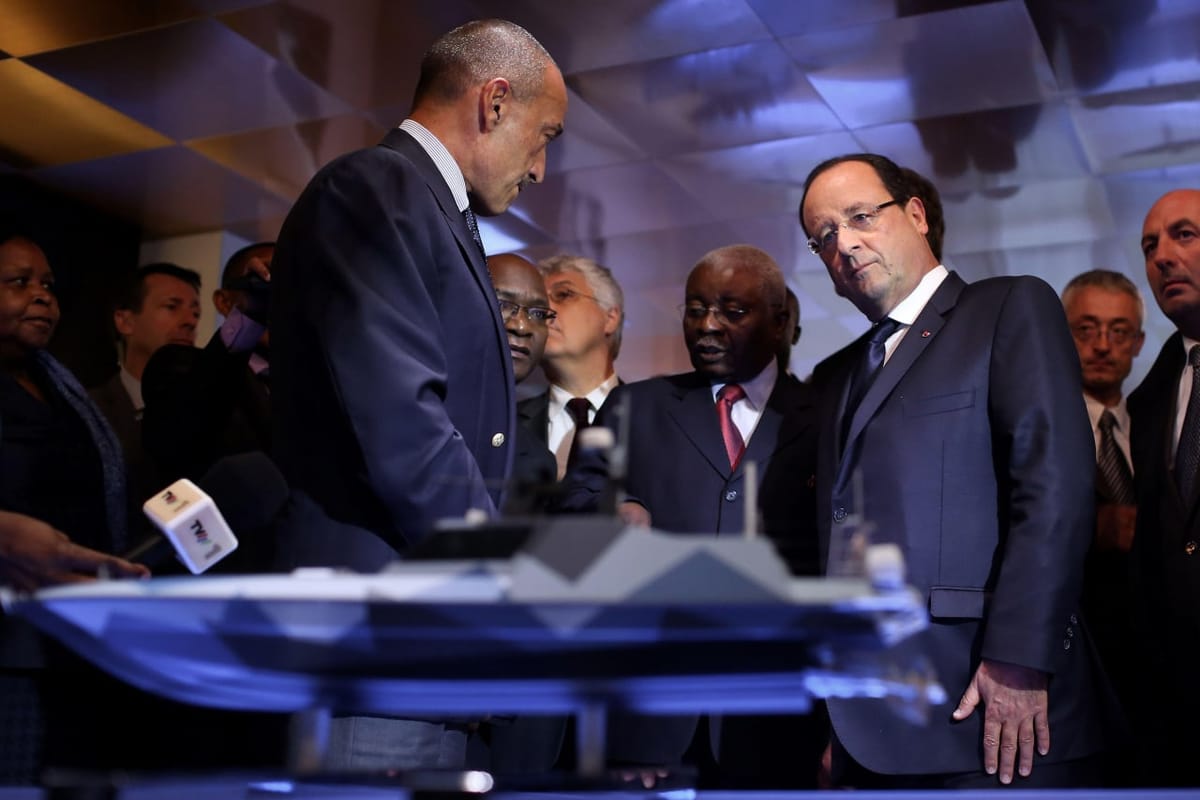

Iskandar Safa, the billionaire head of Privinvest, the shipbuilding group that sold Mozambique boats and other equipment for $2bn in the notorious ‘hidden debts’ deals, died earlier this week, according to a French magazine that he also owned. Safa was described in a Credit Suisse document that emerged in US court proceedings as a “master of kickbacks”, alongside three Credit Suisse bankers' testimony that they received bribes from Privinvest. Despite this, Safa avoided legal proceedings until last year’s trial in London, although his death will presumably postpone the courts’ impending verdict on his innocence or guilt.

Wednesday

The government, through the National Roads Agency, has moved speedily to repair the roof of an aqueduct supporting the N380 highway, which collapsed for a second time in two weeks at the weekend, under heavy rain. Amidst the rainy season, and with heavier-than-usual rain forecast for Mozambique’s northern provinces, cyclones and flooding in the coming months will likely do more damage to the country’s infrastructure. Though currently the necessary funds for repair and maintenance are more readily available from donors as the country has emerged from the so called “hidden debts” scandal, which made securing such funding much harder.

Thursday

The Bank of Mozambique reduced the reference interest rate by 0.75 percentage points, the first time they have lowered them since June 2020. Though this cut is likely to have little impact as interest rates remain at 16.5%, it does signify the bank’s success at their primary goal of containing inflation which sits at 4-5%. Bank governor Rogério Zandamela made clear that this rate cut was just the first move in a journey of planned rate cuts to be spread over the next 2-3 years. Zandamela’s cautious decision to gradually implement small cuts may be due to this year’s election, which will see an increase in government spending and thereby inflation.

Friday

UK-based Alkemy Capital Investments has announced a non-binding agreement with Syrah Resources, the Australian owner of the Balama Graphite mine in Cabo Delgado, to develop a processing plant for battery materials in the UK. The two companies will enter into a 50:50 joint venture to produce 20,000 tonnes of active anode material per year using Mozambican graphite, and will target European markets. The companies foresee an increase in graphite demand from the electric vehicle market, which combined with recent export restrictions in China, the world's largest exporter of graphite, suggest such a venture could be highly promising.